You Have More Equity In Your Home!

More homeowners have gained equity if you own a home on the San Francisco Peninsula, according to a new report released today.

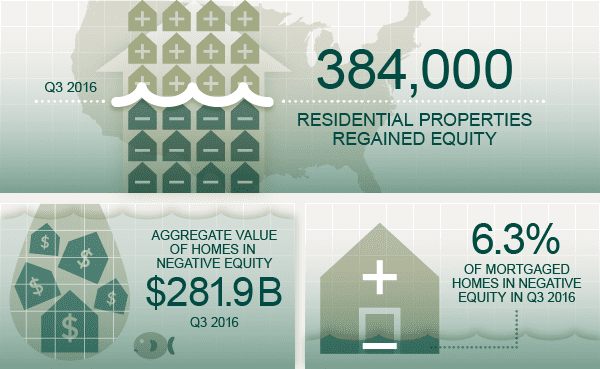

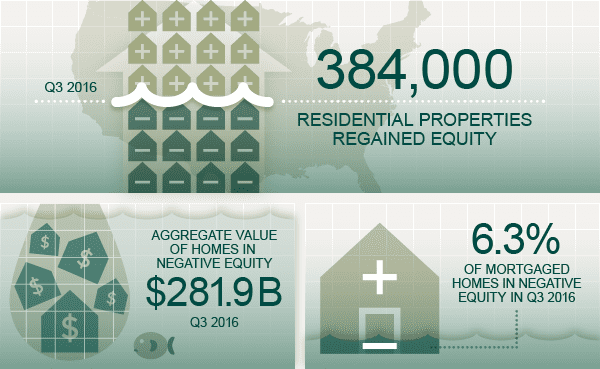

CoreLogic® (NYSE: CLGX), a global property information, analytics and data-enabled solutions provider, just released an analysis showing that U.S. homeowners with mortgages (roughly 63 percent of all homeowners) saw their equity increase by a total of $227 billion in Q3 2016 compared with the previous quarter, an increase of 3.1 percent.

According to Frank Nothaft, the chief economist for Corelogic: “Home equity rose by $12,500 for the average homeowner over the last four quarters. There was wide geographic variation with homeowners in California, Oregon and Washington gaining an average of at least $25,000 in home equity wealth.”

The main cause of equity increase? Anand Nallathambi, president and CEO of CoreLogic: “Price appreciation is the main ingredient for home equity wealth creation, and home prices rose 5.8 percent in the year ending September 2016 according to the CoreLogic Home Price Index. Paydown of principal is the second key component of equity building. Many homeowners have refinanced into shorter-term loans, such as a 15-year loan, and by doing so, they have significantly fewer mortgage payments and are able to build equity wealth faster.”

The metro level, with the cities that have the highest percentage of mortgaged properties with positive equity are:

- San Francisco-Redwood City-South San Francisco, Calif.: 99.4%

- Houston-The Woodlands-Sugar Land, Texas: 98.5%

- Denver-Aurora-Lakewood, Colo.: 98.4%

- Los Angeles-Long Beach-Glendale, Calif.: 96.9%

If you would like a copy of CoreLogic’s 3rd Quarter 2016 Equity Report, and/or what this means for you if you are thinking of Selling, send me an email to rafaelcastrojr@gmail.com or give me a call at 650 483-4932.