Why? High home prices due to lower-than-normal housing supply, higher mortgage rates, high inflation and homebuyers made uneasy due to what all these issues have in store for the near future.

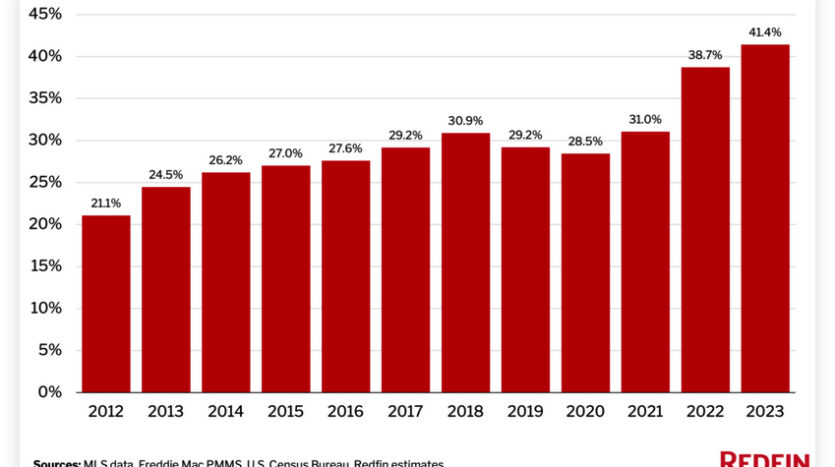

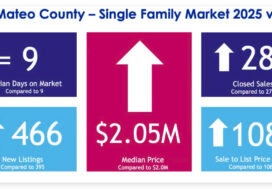

How It’s Unaffordable: Using information/data for a typical homebuyer using median home sale prices, and medium US income of $78,642 in 2023, the homebuyer would have to spend 41.4% of their earnings on monthly housing costs. This is on a median priced home in the United States of $408,806. This assumes using a 30-year fixed loan mortgage at 6.73% (here in the SF Bay Area, median prices are higher, but income is also higher).

The Bad for the buyer: A common rule of thumb is that a buyer should not spend more than 30% of their income on housing and obviously that number has increased substantially with higher mortgage rates and higher home prices. This has left many buyers on the sidelines waiting for rates to drop, or home prices to drop.

The Good: But there is good news in the on the horizon for 2024: mortgage rates have begun falling, and “For Sale” listings have begun going up recently, the most in two years. For example new listings are up 7% from 2022 and are trending upward. Most mortgage loan experts expect mortgage rates to fall to approximately 6.5% in 2024. With the trending lower rates, and more inventory to choose from, buyers can expect better conditions which of course is good for the seller since sellers can also be buyers.

What to Do Now: Definitely have your finances in order, get pre-approved for a home loan, target the type of home and the price range you can afford (you can get the home now and re-finance later), know the neighborhood well where you want to purchase and stay up to date on all the relevant information on new types of purchase loans and when rates begin to drop. Have a seasoned real estate professional guide you on all the aspects of home buying and home selling.

What I Do: At least 167 Things I, a REALTOR Does For His Clients: https://www.smartzonecar.org/what-realtors-do